There seems to be a growing trend amongst Americans, and it is one that has the potential to largely affect the real estate market and the economy as a whole. Findings in the latest Census strongly suggest that more and more people are choosing to live alone. According to the findings, one-person households now account for more than one in four households in America.

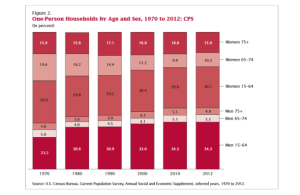

In the past 40 years, the percentage of Americans living on their own has gone from 17 to 27. This share is greater than at any time in the past century. A close look at the numbers shows that around 33 million people in America live alone, a number that has tripled since 1970.

There are many reasons that this phenomenon has taken place. An obvious reason is that less people are getting married and having children or, at the very least, they are waiting until later to do so. Since 1970, the Census has found that the share of households consisting of married couples with children has declined from 40 percent to 20 percent.

The advancement of technology has also played a tremendous role in helping connect the world in ways that do not require as many people to live together. Technological and medicinal advancements are also to thank for the fact that most people are living longer, which means many of these single person households belong to the healthy elderly folks who are no longer in need of nursing homes.

Most would assume that the recession had caused the pace of this trend to slow down, due to younger adults moving in with their parents and others moving into homes together in order to share expenses. However, the Census also found that since 2007, 2 million more Americans live alone. Surprisingly, the Great Recession may have contributed to the trend since marriage rates tend to hit a lull in poor economic times.

Overall, the trend may actually have a positive impact on real estate and the economy as a whole. Of course, less people sharing homes means more homes will be sold. This also means that less supplies and energy will be shared. While this naturally would not be ideal for the environment, it also points to an upward trend in the rate of consumer spending.